Table of Contents

Introduction

Managing healthcare institutions has become very complex. Precision and efficiency in the healthcare domain are keystones. Yet, despite technological advancements and patient care practices, many hospitals still struggle with outdated payment systems.

A hospital might excel in medical care, offering state-of-the-art equipment and highly skilled staff, but if its payment systems are outdated, the patient experience suffers dramatically. Imagine a scenario where critical insurance approval is delayed due to outdated payment systems. The result isn’t just financial strain—it could mean life-threatening delays for patients needing urgent care.

When hospitals fail to upgrade their systems, it leads to inefficiencies, soaring costs, operational bottlenecks, and affects patient experience, etc. These systems may appear operational at first glance, but they can have extreme hidden costs that impact all parties involved in the healthcare system.

The hidden costs of these inefficiencies go beyond monetary losses—they impact the entire ecosystem, from providers to patients. With the help of actual data, we shall examine the wide-ranging operational and financial effects of ineffective payment methods on the healthcare industry in this blog.

We’ll also look at cutting-edge tools like PayNova that are helping healthcare institutions rebuild their operations and achieve financial stability.

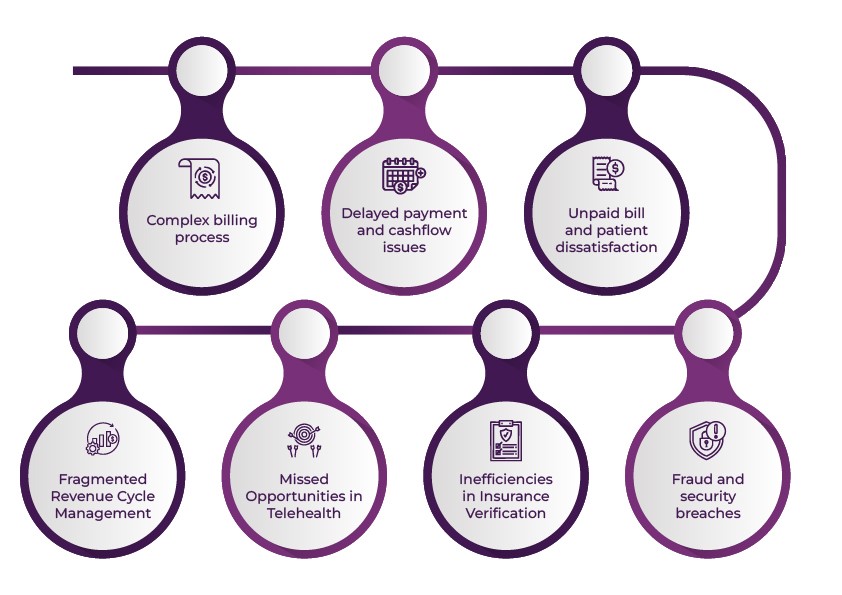

Below are some common issues that clinics face without an efficient billing function:

Healthcare providers in the US face a myriad of challenges when managing payment systems. From complex billing processes to stringent compliance requirements, the hidden costs of inefficient payment systems extend far beyond financial losses.

Problem 1: Complex billing process

One of the most significant challenges healthcare providers encounter is the complexity of billing. Managing multiple payers—patients, insurance companies, Medicare, and Medicaid—and adhering to intricate billing codes (e.g., ICD-10 for diagnoses and CPT for procedures) leads to frequent errors and delays.

When billing complexity becomes complex, hospitals must recruit specialized billing staff. Staff spend hours on manual billing and payment reconciliation, leading to inefficiencies. For instance, correcting billing errors costs providers an average of $118 per claim. That will raise the operational cost of hospitals.

Secondly, denied claims and delayed reimbursements are caused by coding mistakes. A study by Change Healthcare found that nearly 9% of all claims are denied, with 86% of denials being preventable. Of these preventable denials, up to 42% are caused by coding mistakes or insufficient documentation. The average cost to rework a denied claim is $25, while unresolved denials can lead to revenue losses of $4.9 million annually for a typical hospital.

Thirdly, frustration among patients is due to unclear bills and payment obligations. According to a survey by InstaMed, 70% of patients are confused by their medical bills and find them challenging to understand.

Problem 2: Delayed payment and cashflow issues

According to a recent study, 78% of healthcare providers cannot collect bills of more than $1000 in 30 days. These statistics are more than just inconvenient. They can have a a devastating impact on healthcare providers’s financial stability.

When payments are delayed, cash flow is disrupted, making it difficult for healthcare practices to meet their daily operational needs. A steady cash flow is essential for covering payroll, ordering supplies, and managing other critical expenses.

For example, a dental practice that relies on timely payments to pay for dental materials may be unable to fulfil those orders, leading to delays in patient care.

Delayed payments can mean insufficient funds to cover payroll, reducing staff. This domino effect impacts the quality of care healthcare practices can provide. Eventually, it increases the administrative burden for follow-ups and reduces the ability to invest in patient care improvement.

Problem 3:Unpaid bill and patient dissatisfaction

A survey by Trans Union Healthcare revealed that 68% of patients are confused by their medical bills. The difficulty in processing the billing and the complex process of paying the bill become the biggest bottlenecks. This confusion by medical bills leads to delayed payment or outright defaults. Furthermore, 22% of patients have failed to pay their medical bills in the past year due to a poor understanding of the payment process. These unpaid bills lead to write-offs, and lastly, this will strive for patient-provider relationships.

Long waiting times and inaccurate information may negatively impact patient experience and staff, causing them to lose hospital trust. This confusion soars up patient dissatisfaction and complaints. The patient would opt for another healthcare provider. These issues lead to a decline in patient retention and new patient acquisition. Therefore, clinics must address billing issues head-on to maintain their reputation and provide high-quality patient care.

Problem 4: Fraud and security breaches

Fraud and data breaches in healthcare are grave concerns. When healthcare providers use outdated payment systems, they are often vulnerable to fraud and data breaches. One of the remaining incidents is the 2021 ransomware attack on the US healthcare system. By hacking the outdated payment systems, 3.5 million patient records were leaked, which cost the provider over $50 million in recovery efforts and fines.

These fraud and security breaches lead to financial penalties and legal liabilities, loss of patient trust, and long-term damage to provider reputation. Modern, secure payment systems mitigate these risks while ensuring compliance with HIPAA and PCI-DSS standards.

Problem 5: Inefficiencies in Insurance Verification

Manual insurance verification is time-intensive and error-prone, contributing to care delivery and reimbursement delays. The Council for Affordable Quality Healthcare (CAQH) estimates that healthcare providers could save $11 billion annually by fully automating insurance verification and claims processing.

Impact:

- Increased administrative time for eligibility checks.

- Patient frustration from delayed care.

- Higher error rates in claim submissions.

Example: A single error in insurance verification can lead to a cascade of issues, including patient dissatisfaction and claim rejections, costing providers up to $20 per error to resolve.

Problem 6: Missed Opportunities in Telehealth

Streamlined telehealth payments could save the US healthcare system $10 billion annually. The rise of telehealth has exposed gaps in payment processes, with many systems unable to handle remote care billing efficiently. Simplifying telehealth payments encourages adoption and improves patient satisfaction.

Problem 7: Fragmented Revenue Cycle Management

A healthcare professional may become confused while handling payments from several sources. Black book market research estimates that healthcare providers lose over $125 billion annually due to disjointed systems’ revenue leakage. Payroll delays and higher operating costs will result from manual reconciliation procedures.

All the processes will be streamlined once the providers use an integrated system like PayNova. For healthcare providers, it improves income predictability, streamlines workflow, and lowers workloads.

Solution for the hidden cost of inefficient payment systems in healthcare

- Choose a Payment Gateway with Transparent Fees: Opt for payment systems with clear, competitive, and predictable pricing to avoid surprise transaction fees that could add to operational costs.

- Implement Real-Time Payment Processing: Use a real-time payment system that processes transactions, ensuring immediate payments and minimizing cash flow delays.

- Offer Multiple Payment Options: Enable a variety of payment methods such as credit/debit cards, digital wallets, insurance payments, and payment plans to provide convenience for patients and reduce payment friction.

- Automate Billing and Invoicing: Integrate automated billing and invoicing with your payment systems to reduce manual work, lower administrative costs, and prevent human errors.

- Improve Payment Security: Invest in a secure payment system that meets compliance standards such as PCI-DSS and HIPAA to protect patient data and avoid potential fines or security breaches.

- Integrate Payment Gateway with Healthcare Systems: Ensure the payment systems integrate seamlessly with Electronic Health Records (EHR) and other healthcare management systems for efficient data flow and reconciliation.

- Use Recurring Billing for Consistency: Implement recurring billing for patients on subscription plans (e.g., for ongoing treatments) to reduce the complexity of billing and ensure timely payments.

PayNova: Powerful payment gateway for healthcare transaction

Choosing the right payment systems for your healthcare can be challenging. Healthcare providers need to educate themselves when opting for the right tool. Amid a lot of options, PayNova stands exclusive for healthcare transactions. PayNova is taking a bold step forward by introducing advanced features that simplify payment processing and boost financial outcomes for healthcare providers.

What Makes PayNova Stand Out?

It simplified Payment Processes.

Healthcare providers can integrate patient payments, insurance reimbursements and third-party transactions into a single platform. They don’t need to use multiple sources to access the payment process. Integrating reduces manual errors and claims rejection and boosts the revenue growth of hospitals. It ensures healthcare providers can focus on care delivery instead of chasing payments.

Patient-Centric Flexibility

Healthcare providers’ success depends on how they understand patient’s financial strains. PayNova makes flexible payment options such as instalment-wise, digital wallets and payment tracking at their convenience. These features increase patient satisfaction and improve timely payments.

Data Security and Compliance

The best medical payment systems should comply with HIPAA and PCI-DSS standards. PayNova is built with security for sensitive patient and financial data. Its rebuilt encryption protocols protect against fraud and breaches and build patient and provider trust.

Automation and Insights

Tracking the payment status on a single platform will be more convenient for healthcare providers. PayNova automates at its core to handle things like insurance verification, claim submission and reconciliation without manual intervention. So that healthcare providers can easily analyze bottlenecks and financial operations using the PayNova dashboard.

End notes:

Every payment on time can save millions of lives. By implementing a comprehensive payment gateway like PayNova, healthcare providers can simplify their medical billing processes easily. So that clinics can streamline their medical billing processes, reduce errors, and minimize payment delays, allowing healthcare providers to focus on patient care and improving their overall reputation.

Frequently Asked Questions:

What are the hidden costs of inefficient payment systems in healthcare?

- Inefficient payment systems can result in higher operational costs, delayed payments, increased administrative workload, poor patient experience, fraud, security breaches, and loss of revenue opportunities.

How do complex billing processes affect healthcare providers?

- Complex billing processes can lead to frequent errors, denied claims, and delayed reimbursements, which can result in increased operational costs and reduced revenue.

Why are delayed payments a significant problem for healthcare providers?

- Delayed payments disrupt cash flow, making it difficult for healthcare practices to cover daily operational expenses such as payroll, supplies, and patient care.

How does confusion around medical bills impact patients and healthcare providers?

- Patient confusion leads to delayed payments or defaults, negatively affecting the patient-provider relationship and resulting in financial losses and patient dissatisfaction.

What are the risks of fraud and security breaches in healthcare payment systems?

- Outdated payment systems are vulnerable to fraud and data breaches, which can lead to financial penalties, legal liabilities, and loss of patient trust.

How does inefficient insurance verification impact healthcare operations?

- Manual and error-prone insurance verification can cause delays in care delivery, increase administrative workload, and lead to claim rejections and revenue loss.

What are the benefits of automating billing and invoicing in healthcare?

- Automation reduces manual work, minimizes errors, lowers administrative costs, and ensures faster and more accurate billing processes.

How does PayNova help in streamlining payment processes for healthcare providers?

- PayNova integrates patient payments, insurance reimbursements, and third-party transactions into a single platform, reducing manual errors, boosting revenue growth, and improving operational efficiency.

What makes PayNova a secure choice for healthcare transactions?

- PayNova complies with HIPAA and PCI-DSS standards, ensuring the highest level of security for sensitive patient and financial data.

How does PayNova improve patient satisfaction and payment collection?

- PayNova offers flexible payment options, such as instalment plans and digital wallets, which make it easier for patients to pay and improve timely payments.

Can PayNova help reduce claim denials in healthcare billing?

- PayNova automates key billing processes, including insurance verification and claim submissions, to reduce errors and denials.

How does PayNova enhance financial insights for healthcare providers?

- PayNova’s dashboard provides healthcare providers with real-time insights into payment status, bottlenecks, and financial operations, helping them make informed decisions.

What are the key features of PayNova that benefit healthcare providers?

- PayNova simplifies payment processing, offers patient-centric flexibility, ensures data security and compliance, and automates insurance verification and claims processing.